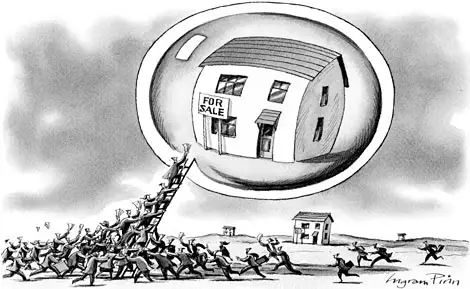

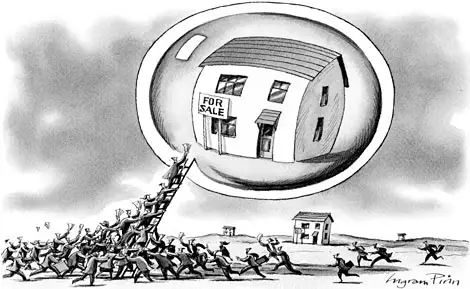

The real estate bubble, commonly known as the property bubble, is a term that refers to an economic "bubble" that occurs in real estate markets from time to time. The term bubble arises as property values soar, reaching unsustainable levels, and then decline rapidly, bursting the bubble.

How are real estate bubbles identified?Over the years, it's been difficult for real estate bubbles to be identified before they burst. This has been to the detriment of the real estate market that suffers for long periods of time when a real estate bubble does indeed burst.

Once a real estate bubble has burst, property values decline rapidly, and this leads to people holding a mortgage that's worth much more than the value of their property. This is known as negative equity, which can be disastrous to certain individuals.

If a person has negative equity with their property it means that their assets are worth less than their debts. In the case where someone can no longer afford to pay their mortgage, their property is not worth enough to cover the debts once sold. Therefore, the person would lose their property and remain in debt, too.

Ultimately, real estate bubbles are very difficult to identify, although there are modern methods used to attempt to do so. By measuring the price of property compared to what most people can afford, it is possible to predict when a real estate bubble is one the verge of bursting.